rhode island tax rates 2020

Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of. 26100 for those employers that have an experience rate of 959 or higher Employers will be notified in.

Start filing your tax return now.

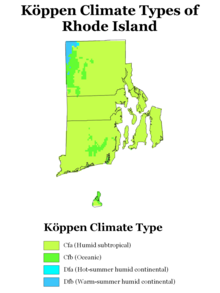

. 1 Rates support fiscal year 2020 for East Providence. 3 West Greenwich - Vacant land taxed at. Explore data on Rhode Islands income tax sales tax gas tax property tax and business taxes.

About Toggle child menu. State of Rhode Island Division of Municipal Finance Department of Revenue. Tax amount varies by county.

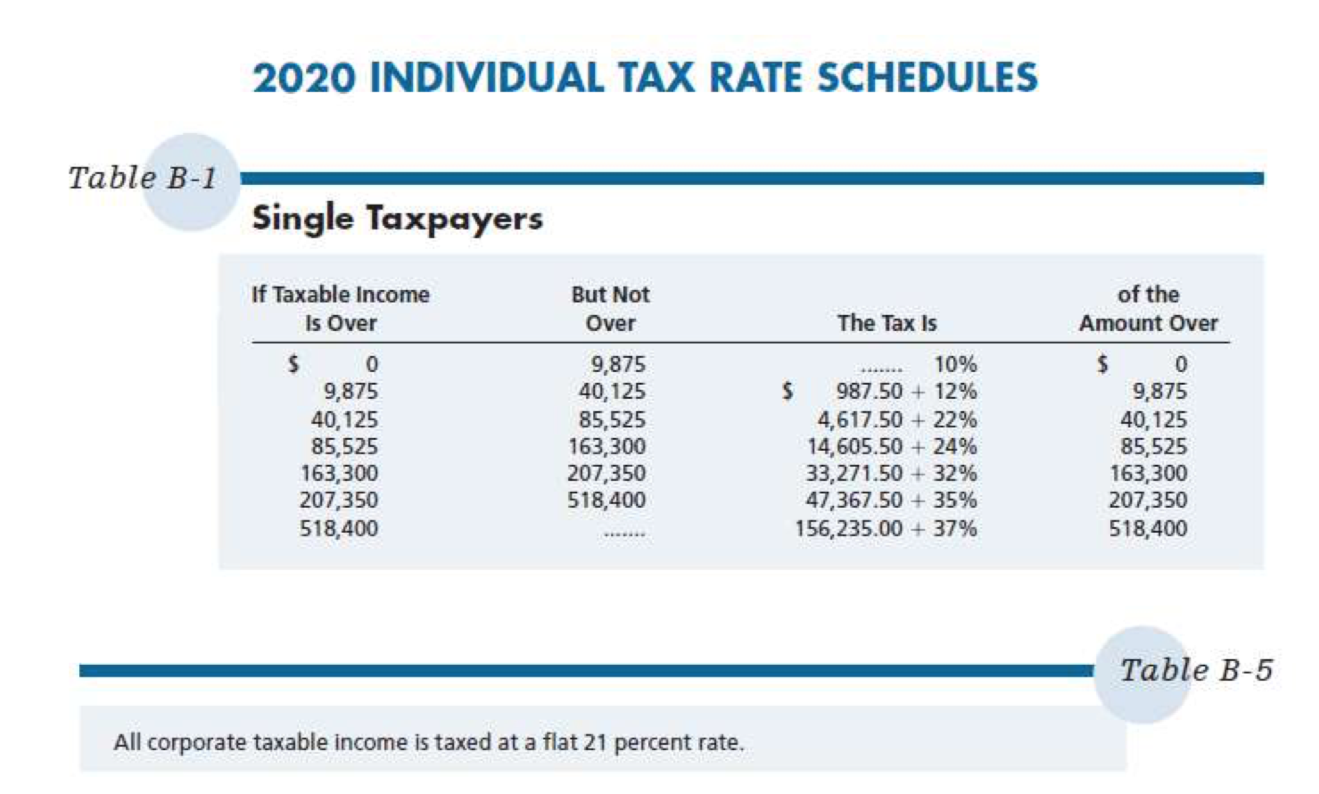

Rhode Island Income Tax Rate 2022 - 2023. RI or Rhode Island Income Tax Brackets by Tax Year. Detailed Rhode Island state income tax rates and brackets are available on this page.

2 Municipality had a revaluation or statistical update effective 123119. Detailed Rhode Island state income tax rates and brackets are available on this page. Less than 100000 use the Rhode Island Tax Table located on.

Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year 2019 and the tax rates were previously changed in 2009. A list of Income Tax Brackets and Rates By Which You Income is Calculated. Comprehensive Plan 2020-2040.

41 rows Rhode Island Property Tax Rates. Learn about Rhode Island tax rates rankings and more. Rhode Islands tax brackets are indexed.

Includes All Towns including Providence Warwick and Westerly. 135 of home value. Tax Rate 0.

The top rate for the Rhode Island estate tax is 16. Sources of State and Local Tax. The Rhode Island sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the RI state tax.

Rhode Island Tax Brackets for Tax. If you live in Rhode Island and are thinking about estate planning this. It kicks in for estates worth more than 1648611.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Fiscal Year 2021 - Tax Roll Year 2020 tax rate per thousand dollars of assessed value Click table headers to sort. 2020 Rhode Island Property Tax Rates on a Map - Compare Lowest and Highest RI Property Taxes Easily.

15 Tax Calculators. The current tax rates and exemptions for real estate motor vehicle and tangible property. Start filing your tax return now.

The federal corporate income tax by contrast has a marginal bracketed corporate. The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three.

Exemptions to the Rhode Island sales tax will vary by state. Rhode Island has a flat corporate income tax rate of 7000 of gross income.

Pandemic Profits Netflix Made Record Profits In 2020 Paid A Tax Rate Of Less Than 1 Percent Itep

How Do State And Local Sales Taxes Work Tax Policy Center

General Income Tax Factors Fringe Benefits Lo 3 Chegg Com

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Calculator Smartasset

Newport Councilors Target Higher Property Taxes For Short Term Rental Homeowners

Ri Health Insurance Mandate Healthsource Ri

How Illinois Income Tax Stacks Up Nationally For Earners Making 100k Center For Illinois Politics

Rhode Island Nursing Homes With Covid 19 Wpri Com

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Rhode Island Key Performance Indicator Briefing For Q4 2021 Ri S Post Pandemic Economy Grows But Still Lags The Nation In Recovering Jobs Rhode Island Public Expenditure Council

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

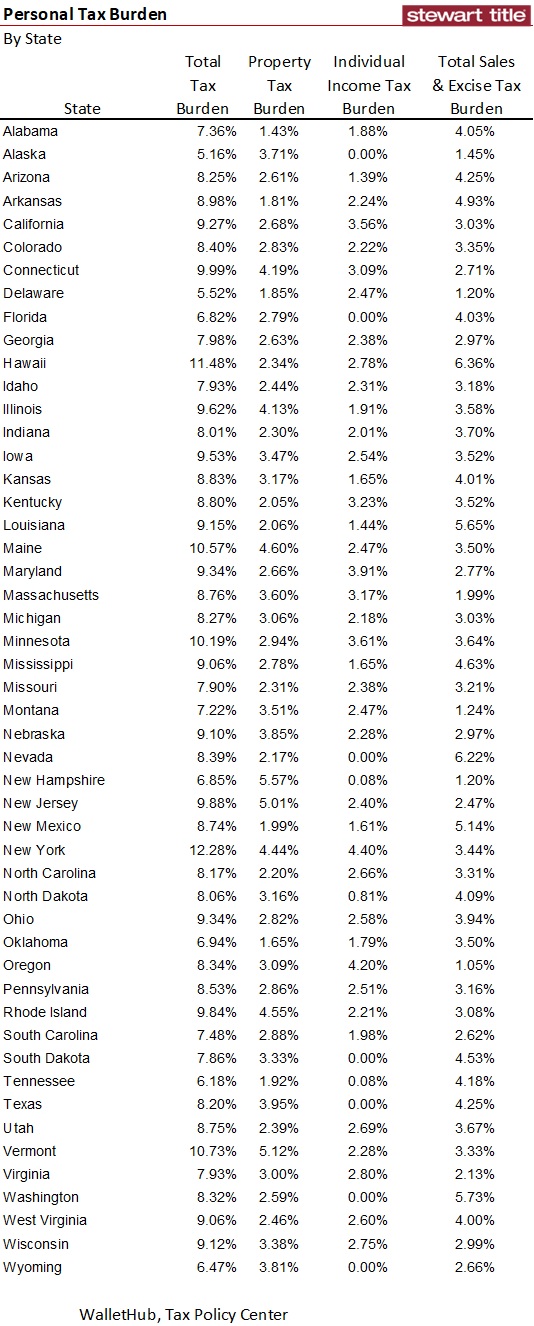

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

State Taxes On Capital Gains Center On Budget And Policy Priorities

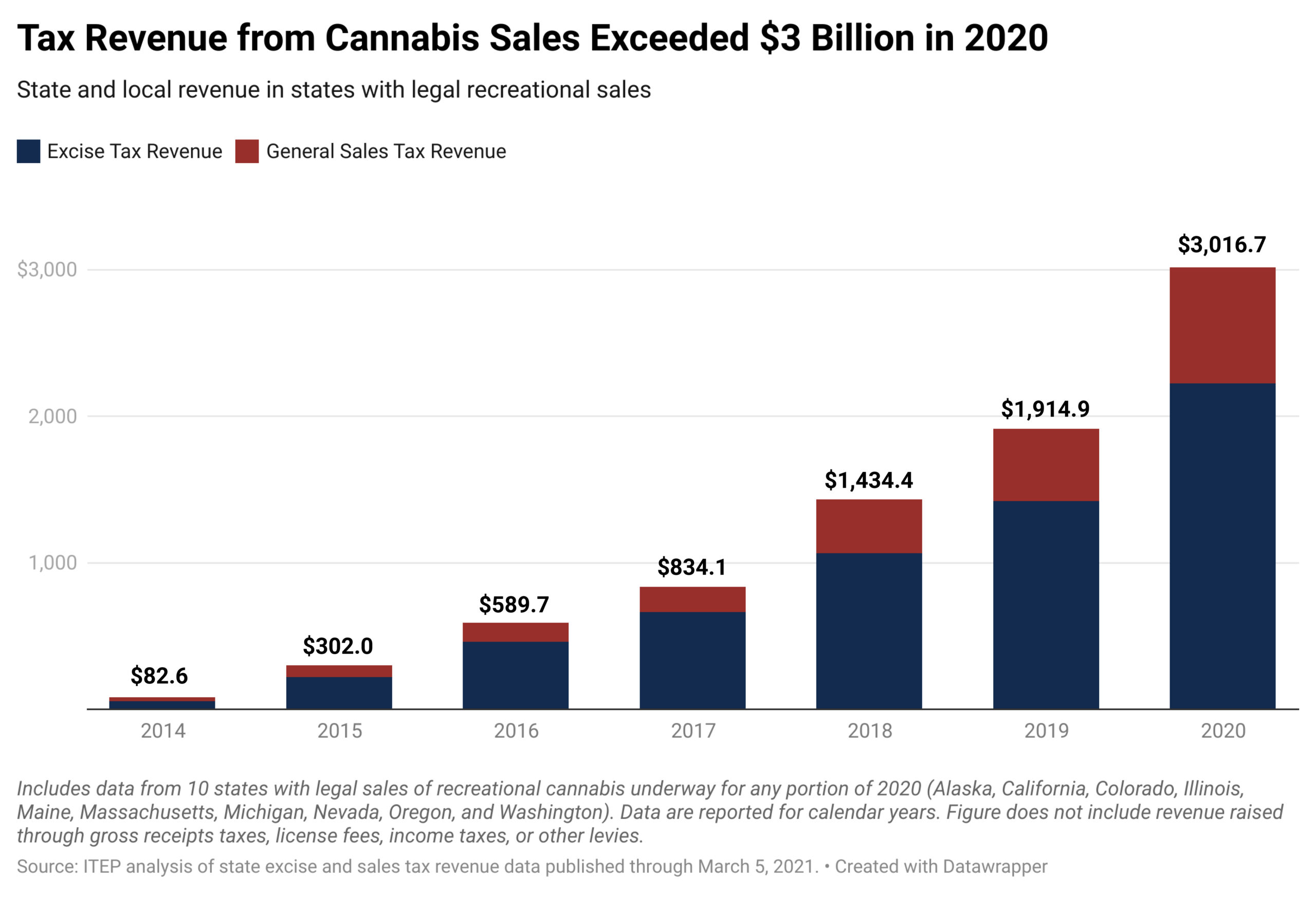

State And Local Cannabis Tax Revenue Jumps 58 Surpassing 3 Billion In 2020 Itep

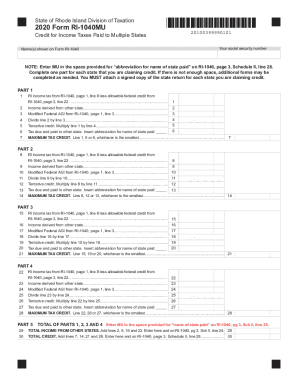

Ri 1040 Instructions 2020 Fill Out And Sign Printable Pdf Template Signnow

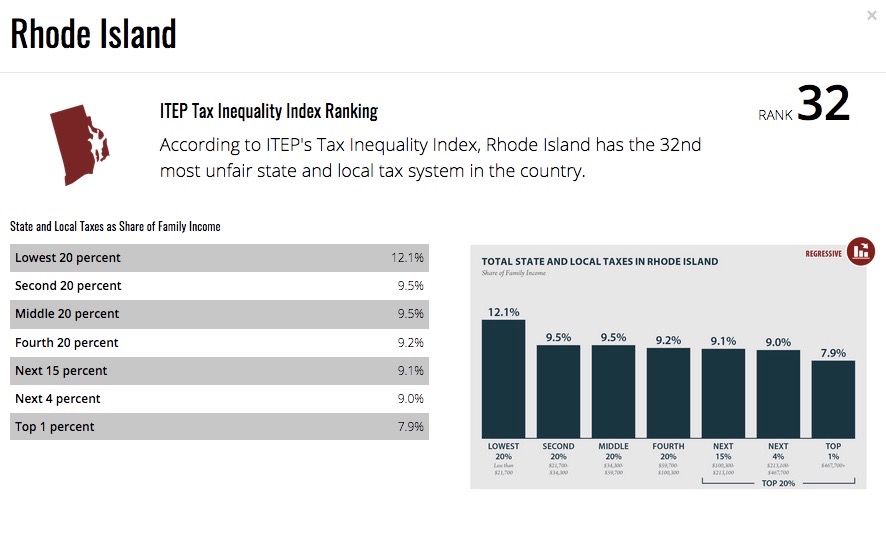

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest